Here we go (again)!

New financial year, new target – and if you’re anything like most partners or senior lawyers we work with, your internal monologue probably sounds like:

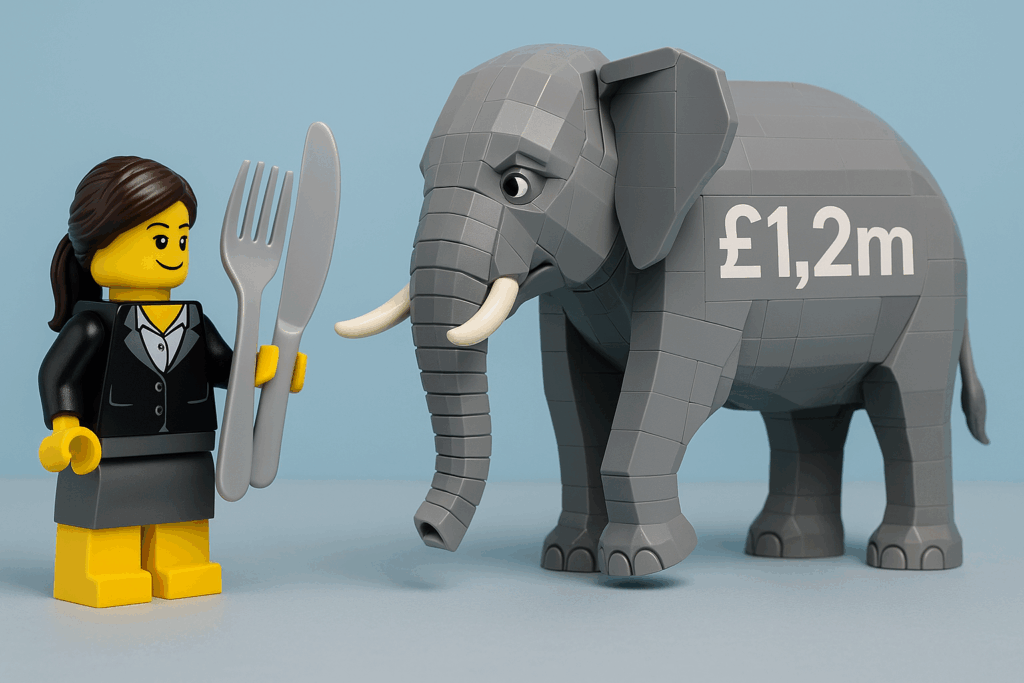

“£1.2m? Are they mad? That’s 1,200,000 actual pounds. That’s a lot of conveyancing…”

But fear not. Over the course of the next three week’s, we’re going to show you how to turn that £1.2m target into something a bit less panic inducing and a lot more manageable. Today we concentrate on figuring out your numbers and where you need to be by when. Enjoy.

#1. Eating an elephant

There’s only one way we’ve found to eat an elephant without getting chronic indigestion. You must break it down into manageable bitesize chunks.

How? Take your annual target – we’ll use £1.2m as our baseline – and break it into digestible monthly or quarterly chunks:

- Monthly: £1.2m ÷ 12 = £100k per month

- Quarterly: £1.2m ÷ 4 = £300k per quarter

Now ask yourself – which rhythm suits your practice most? Corporate lawyers may think in quarters, litigators in phases, and private client teams in seasonal chaos. Either way, know your rhythm and map your revenue against it.

Then go further – break down your performance last year by month or quarter. Any patterns? Peaks and troughs? Did September fly because of an M&A sprint? Was February dead due to ski season? Plot it out; forecasting starts with self-awareness, not spreadsheets.

#2. Who’s already contributing to your target?

Targets are met in two ways: repeat work from existing clients, and new instructions from both existing and new clients. Time for a back-of-an-envelope audit:

Start by asking:

- What % of last year’s revenue came from existing clients?

- Is it fair to assume the same this year?

Let’s say 70% came from existing relationships. Apply that here:

- 70% of £1.2m = £840k from existing clients

- That leaves £360k to find elsewhere

This doesn’t need to be precise – you’re building a BD strategy, not submitting your tax return. A rough split provides an indication of where to focus. And if you realise your revenue is heavily reliant on two key clients – you’ve now got a concentration risk to manage too.

#3. Bringing home the bacon

Now we get into the real maths. If you need to bring in £360k from new clients this year, you need to understand two things:

- Your Average Contract Value (ACV) – what is a typical new matter worth?

- Your conversion rates – how many leads become instructions?

Let’s say your average matter is worth £30k. Then:

- £360k ÷ £30k = 12 new instructions needed

- That’s 1 new matter a month on average

- If you’re converting one in four (25%) opportunities, firstly well done you and secondly, this means you need to be generating an opportunity every week to hit your target.

Feeling queasy? Let’s tweak it. If your ACV is £60k, you only need six new clients all year. If it’s £10k, you’ll need thirty-six. Now you’ve got a number. You know what the mountain looks like.

And if you’re not sure what your average matter value is – go ask finance, or better yet, go build a BD dashboard. (Or talk to us – we’re full of spreadsheets, charts, and unsolicited pep talks.)

Next week

Once you know how many new instructions / jobs you need, you can plan the activity needed to generate them. Events, coffee catch-ups, client referrers, speaking gigs, LinkedIn posts – every action now has purpose.

REMEMBER: You’re not “doing BD” – you’re building a pipeline to hit a target. One small hill at a time.